Stormy Seas Are Here, Are You A Saylor?

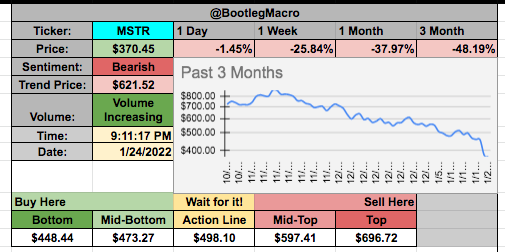

This market can be summed up by one company, one ticker…MSTR. Bet you thought I was going to say TSLA. Nope, Elon didn’t pull lemmings over the cliffs like Michael Saylor did this cycle. The thing I slightly respect about Saylor is, he will go down with his ship. Credibility, equity and livelihood all wrapped into one stock price. That’s not only a sailor, that’s a captain.

A sign of a mania is disconnection from reality. This video is a bit of the absurd which is fitting for the Saylor based on where we are in the cycle now.

This is the part of the journey off the cliff where the ground is very close. If you’re not in pain yet, you’re wincing. Tensing up waiting for impact. I’m sure Michael Saylor is very tense right now.

This downward move will be swift, stern and with plenty of warning. But in a passive investing world mixed with a crypto crowd, a new generation of traders and 2 previous years of “helicopter money” it’s a ocean of liquidity trying to move at once.

Yet, there is opportunity. Across the current of the crowd, in midst the chaos, fear and uncertainty, there are safe places for those nimble enough to nibble. It’s not sexy, it’s pretty scary but if you enjoy the game as much as I do, this is the best time in a market. We have change in the air, we know the storm is coming and the sky is already grey…all we need to do is be prepared to take advantage.

Lets take a quick look around the market at some ETFS I track for my Trade Radar. This will show you a bit of how I look at the market.

Here is what I follow to make this simple and again, this is Bootleg Macro. This is same quality as the moonshine your grandparents drank when they met. You’re in the clearance bin of macro. Don’t be the douchebag who forgets they are in the dollar store and starts asking for a price check.

XLB, XLC, XLE, XLF, XLI, XLK, XLP, XLU, XLRE, XLY, XLV, UUP, TNX

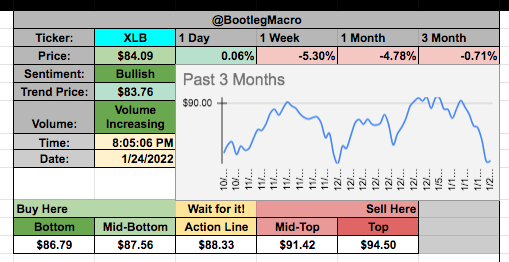

XLB:

A bottom maybe forming.

This blew out the bottom of the range.

There is relative strength evidence this is a good place for when things turn up.

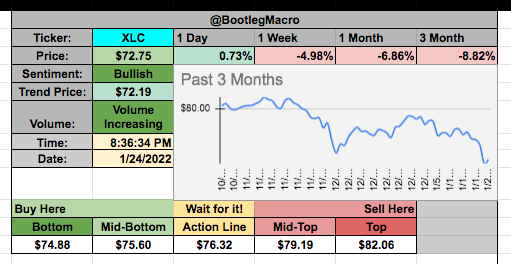

XLC:

This will go bearish tomorrow. I don’t have a neutral for my sentiment, so I can see this should shift to bearish tomorrow with some traditional bearish price action.

I want to short this forever! Well or until the cycle turns again.

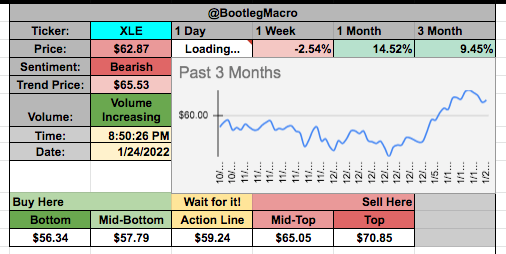

XLE:

Volatility will mean revert eventually and pull oil down with it. But for now, this a place for active traders.

Consider this the black-diamond of trading right now. Unless you wanna get wild and go off the trail and trade natty gas…not for me.

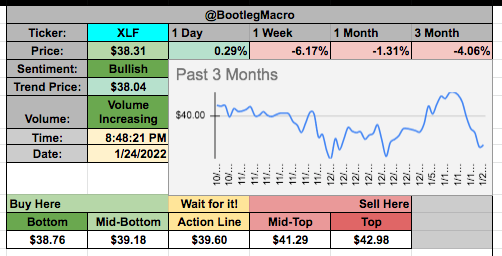

XLF:

Volatility should decrease a bit and pull price up with it. This should be instructive by watching the 10-year (TNX) as well.

At the bottom of it’s range.

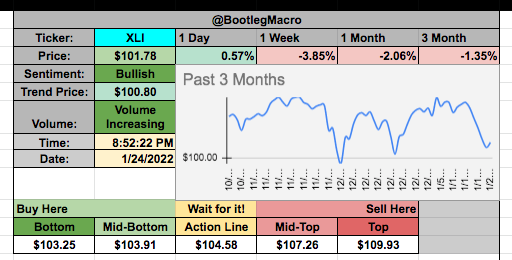

XLI:

Below the bottom of the range.

Volatility is setting up nicely to let this bounce a little.

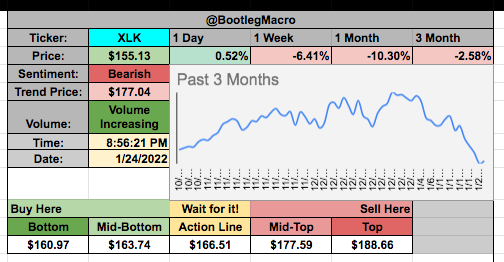

XLK:

This looks like it could keep falling…it’s bearish and has high volatility right now. I’ll stay away from XLK.

Tech is a problem right now and it’s collapsing under the weight of its own valuations.

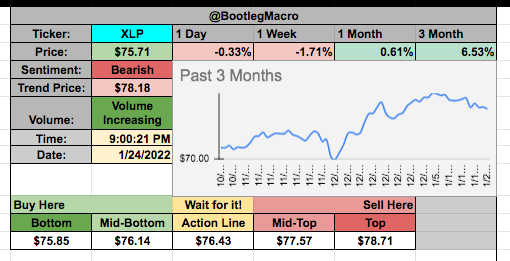

XLP:

I’d say the price starts to rise a little as the volatility comes out.

It’s bearish but hasn’t fallen much during this first part of January.

Strong relative strength.

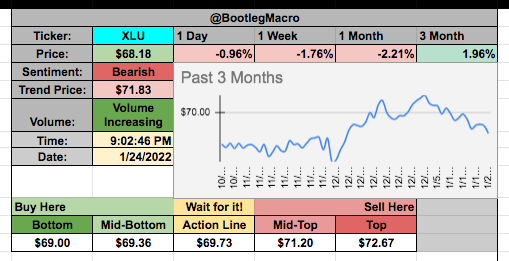

XLU:

I’ll disagree with my signal for now. It’s bearish but I want to buy more.

The price action I think has become very tight and range bound.

A close above $71.83 would be encouraging to the bullish sentiment.

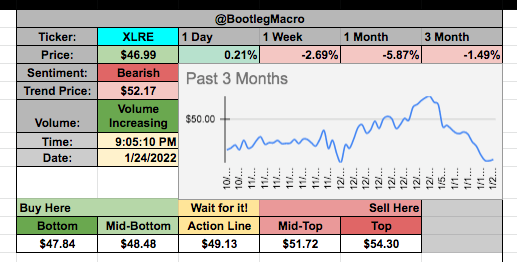

XLRE:

Price is at a level some people would call support.

I’d expect some big up days this week or next for XLRE.

Volatility is a friend of XLRE right now…it’s been an orderly decent.

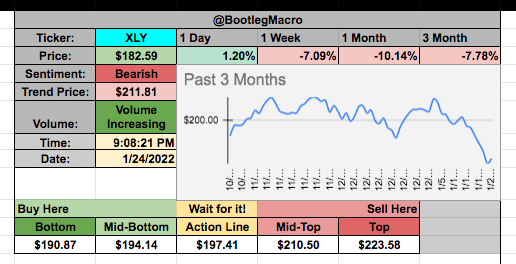

XLY:

This could get ugly. Like bag over the head ugly.

Not interested in anything inside the ETF.

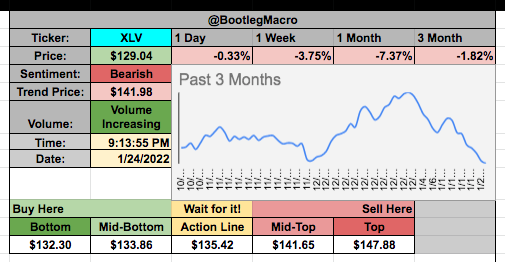

XLV:

I’ve lost money betting this would rebound in the 2022.

So far XLV has done nothing to help my gains as it’s been destroyed during this 1 month selling campaign.

I still believe in the XLV since we are at mid-Nov prices now but we are in a unique situation regarding healthcare due to the pandemic ending.

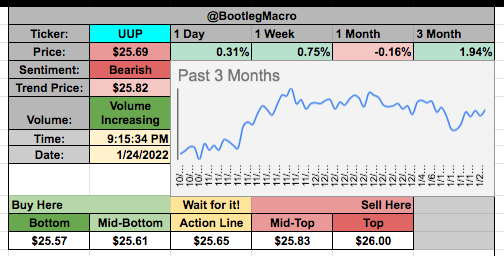

UUP:

Interesting this has been on a nearly-completely negative rolling 1 month return since 12/21/21 but we get no benefits in the stock market.

The dollar ruins the market when it rises and gives us a burst of buying when it falls, right now it’s choppy and the market hates a choppy dollar.

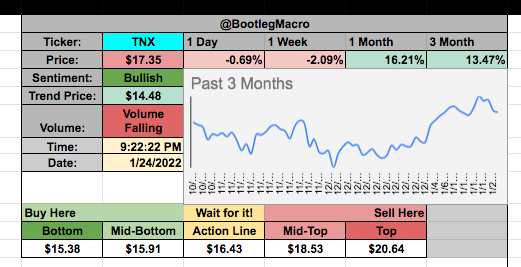

TNX:

Ignore the volume, we get nothing so it will say “Volume Falling” by default.

I’d expect the TNX to drop down to mid-1.50s sometime. Which will have an interesting affect on the rest of the market.

Now before we finish this tour de US stock market for the week of January 23, 2022…I’d like to do something I personally hate, but I know you love it. Degenerate stock traders love picks…stock picks. This isn’t a stock pickers market…well maybe it is since it’s so friggen hard to do. And remember where you are reading about picks…you’re in a newsletter which described it’s quality to your grandparents moonshine. Do you own work, due diligence…whatever. This is for fun for me.

Here are some HOT picks:

Shorts:

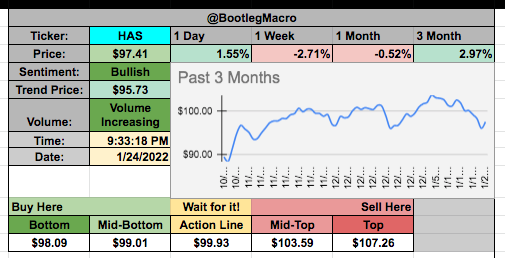

HAS

Great example of a short opportunity before the sentiment goes fully bearish.

Volatility will pick up eventually and pull this below $90.

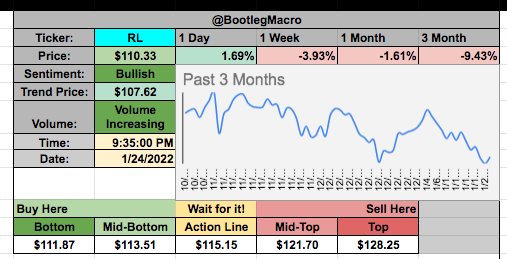

RL

This is at a big support level.

Volatility can pick up easily here.

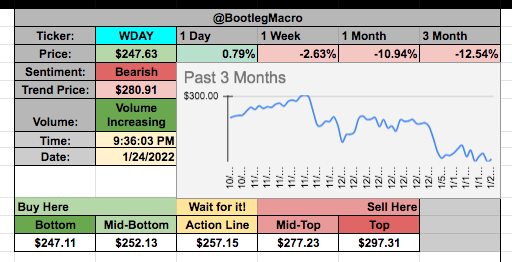

WDAY

I love shorting tech right now.

This has been pretty sold recently, could look for bounce into the mid-240s. Or just short it now and hope it becomes like $CRM and collapses.

Longs:

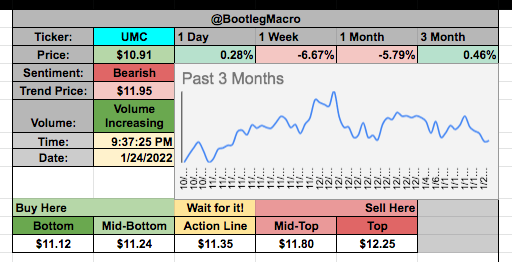

UMC

This has been a strong name in the middle of all the chaos.

I’d buy it here.

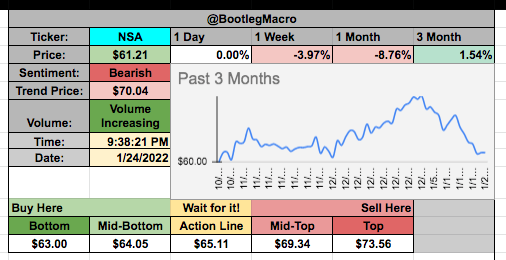

NSA

It’s always weird when something is unchanged for the day. But that’s relative strength right now.

This market is hot trash but NSA is like a ice-cold sparkling water…refreshing.

I did my best to check this for errors, omissions and quality. I’m one man, with a regular job during the day. This is for fun and to create a community of other retail traders who want to build their own tools and process. I’m about 3 things here:

Have Fun

Work Hard

Build a Community

If you don’t like either of those 3 things…have a great day. If you like the work, have questions, are interested in the process, subscribe and follow me on twitter we can interact there or in the comments section here. But be kind, that’s all I ask don’t be the douchebag in the dollar store… I’ll post for free Mondays and Thursdays for 6 months. After that I’ll make a paid tier for better stuff but until then…enjoy. See you Thursday.